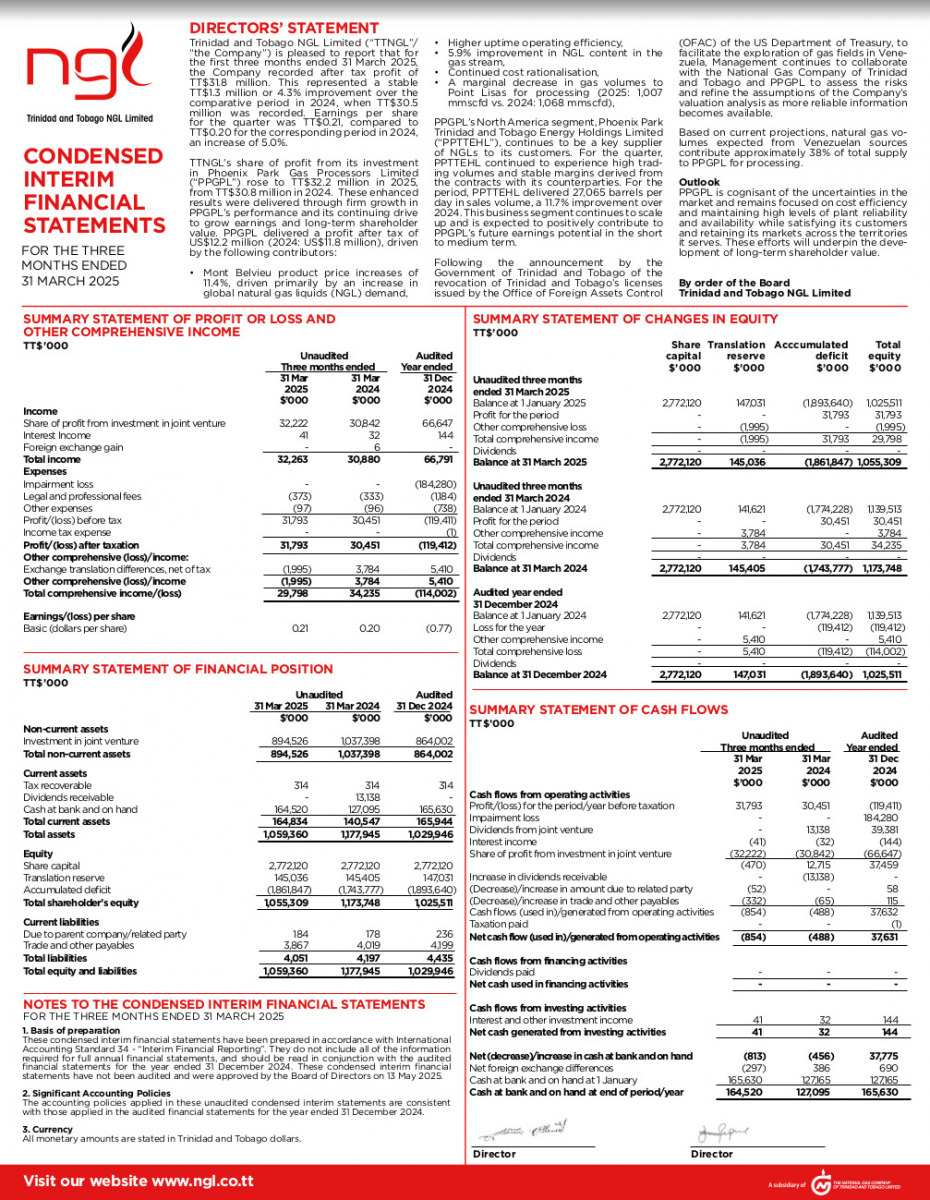

Director’s Statement

Trinidad and Tobago NGL Limited (“TTNGL”/ “the Company”) is pleased to report that for the first three months ended 31 March 2025, the Company recorded after tax profit of TT$31.8 million. This represented a stable TT$1.3 million or 4.3% improvement over the comparative period in 2024, when TT$30.5 million was recorded. Earnings per share for the quarter was TT$0.21, compared to TT$0.20 for the corresponding period in 2024, an increase of 5.0%.

TTNGL’s share of profit from its investment in Phoenix Park Gas Processors Limited (“PPGPL”) rose to TT$32.2 million in 2025, from TT$30.8 million in 2024. These enhanced results were delivered through firm growth in PPGPL’s performance and its continuing drive to grow earnings and long-term shareholder value. PPGPL delivered a profit after tax of US$12.2 million (2024: US$11.8 million), driven by the following contributors:

- Mont Belvieu product price increases of 11.4%, driven primarily by an increase in global natural gas liquids (NGL) demand,

- Higher uptime operating efficiency,

- 5.9% improvement in NGL content in the gas stream,

- Continued cost rationalisation,

- A marginal decrease in gas volumes to Point Lisas for processing (2025: 1,007 mmscfd vs. 2024: 1,068 mmscfd).