Director’s Statement

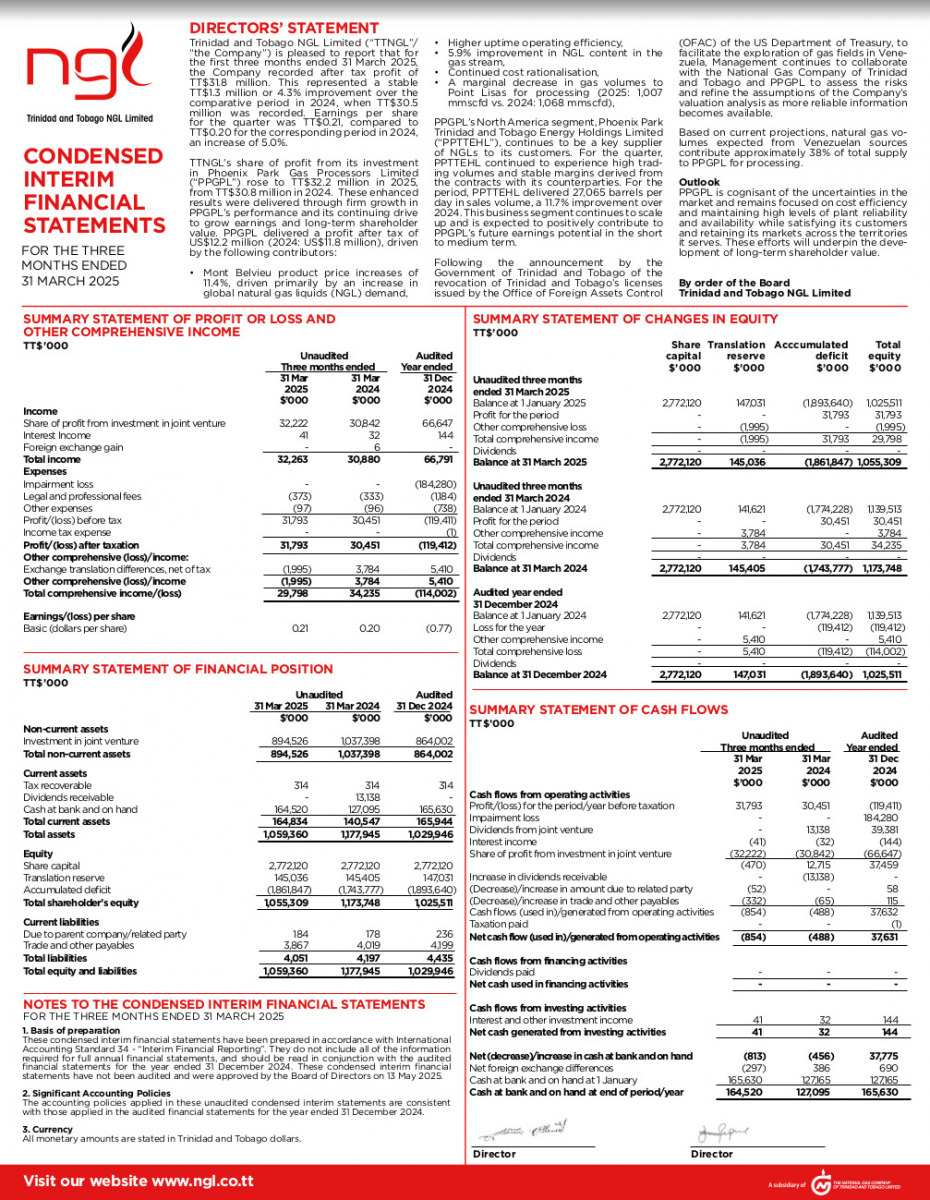

Trinidad and Tobago NGL Limited (“TTNGL”/ “the Company”) presents its financial results for the first six months ended 30 June 2025. For the half-year, the Company recorded share of profit from its investment in Phoenix Park Gas Processors Limited (“PPGPL”) of TT$50.8 million. This represents TT$3.5 million or a 7.4% increase over the comparative period in 2024.

PPGPL delivered profit after tax of US$19.3 million (2024: US$18.0 million), driven by higher uptime operating efficiency, a 2.4% improvement in NGL content in the gas stream and continued cost rationalisation. This was achieved despite a marginal decrease in gas volumes to Point Lisas for processing (2025: 1,013 mmscfd vs. 2024: 1,038 mmscfd) and Mont Belvieu product prices for 2025 remaining flat year on year.

Following the announcement of the revocation of licenses issued by the Office of Foreign Assets Control (OFAC) of the U.S. Department of Treasury, regarding the exploration of gas fields in Venezuela, management has relooked its impairment assessment of the Company’s shareholding investment in the PPGPL Group. This review was conducted based on the assessed most likely outcomes and risks associated with updated inputs and cash flows provided by PPGPL and The National Gas Company of Trinidad and Tobago Limited (“NGC”). This assessment resulted in the recognition of an impairment loss of TT$85.2 million and consequently a loss after tax of TT$35.8 million (2024: profit after tax of TT$46.7 million).