Chairman’s Statement

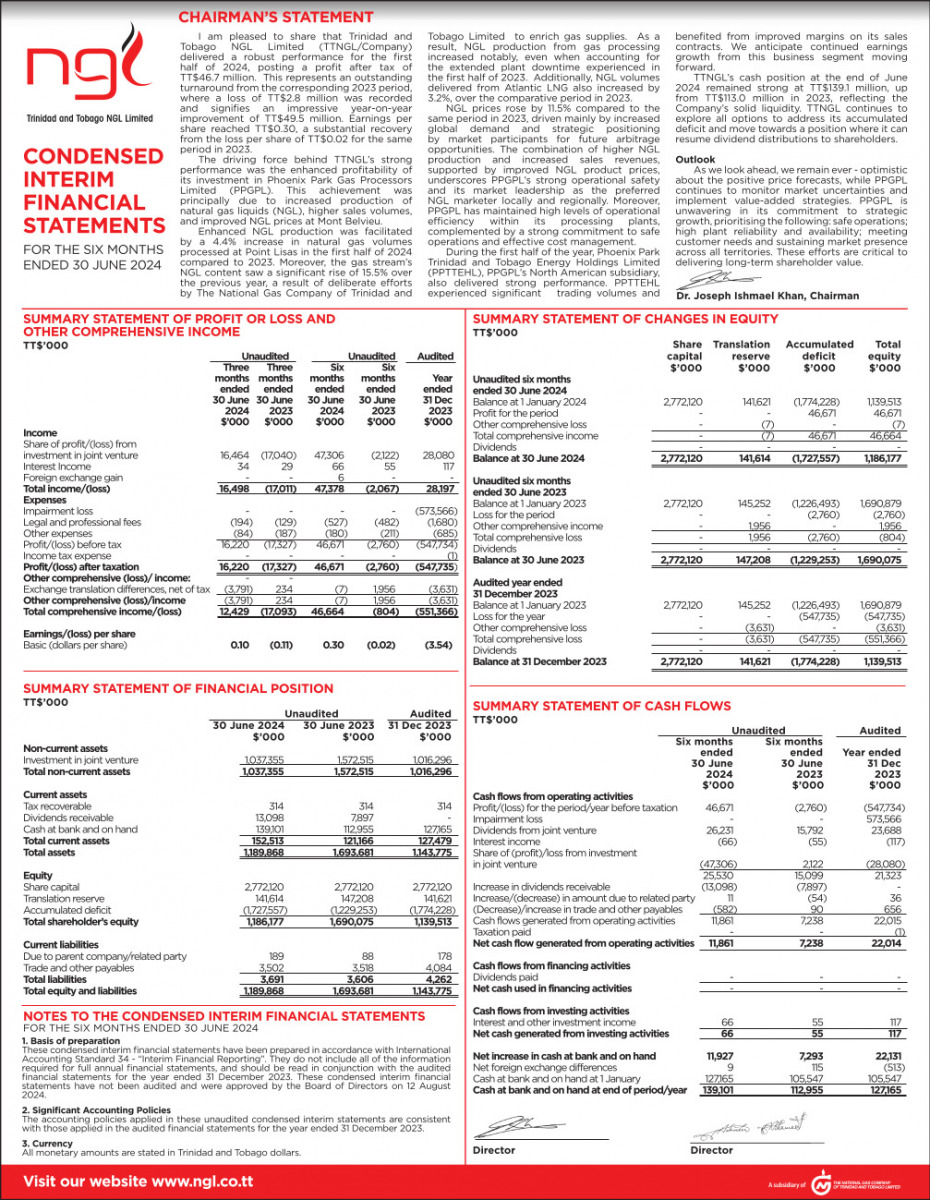

I am pleased to share that Trinidad and Tobago NGL Limited (TTNGL/Company) delivered a robust performance for the first half of 2024, posting a profit after tax of TT$46.7 million. This represents an outstanding turnaround from the corresponding 2023 period, where a loss of TT$2.8 million was recorded and signifies an impressive year-on-year improvement of TT$49.5 million. Earnings per share reached TT$0.30, a substantial recovery from the loss per share of TT$0.02 for the same period in 2023.

The driving force behind TTNGL’s strong performance was the enhanced profitability of its investment in Phoenix Park Gas Processors Limited (PPGPL). This achievement was principally due to increased production of natural gas liquids (NGL), higher sales volumes, and improved NGL prices at Mont Belvieu.

Enhanced NGL production was facilitated by a 4.4% increase in natural gas volumes processed at Point Lisas in the first half of 2024 compared to 2023. Moreover, the gas stream’s NGL content saw a significant rise of 15.5% over the previous year, a result of deliberate efforts by The National Gas Company of Trinidad and Tobago Limited to enrich gas supplies. As a result, NGL production from gas processing increased notably, even when accounting for the extended plant downtime experienced in the first half of 2023. Additionally, NGL volumes delivered from Atlantic LNG also increased by 3.2%, over the comparative period in 2023. NGL prices rose by 11.5% compared to the same period in 2023, driven mainly by increased global demand and strategic positioning by market participants for future arbitrage opportunities. The combination of higher NGL production and increased sales revenues, supported by improved NGL product prices, underscores PPGPL’s strong operational safety and its market leadership as the preferred NGL marketer locally and regionally. Moreover, PPGPL has maintained high levels of operational efficiency within its processing plants, complemented by a strong commitment to safe operations and effective cost management. During the first half of the year, Phoenix Park Trinidad and Tobago Energy Holdings Limited (PPTTEHL), PPGPL’s North American subsidiary, also delivered strong performance. PPTTEHL experienced significant trading volumes and benefited from improved margins on its sales contracts. We anticipate continued earnings growth from this business segment moving forward.

TTNGL’s cash position at the end of June 2024 remained strong at TT$139.1 million, up from TT$113.0 million in 2023, reflecting the Company’s solid liquidity. TTNGL continues to explore all options to address its accumulated deficit and move towards a position where it can resume dividend distributions to shareholders.

Outlook

As we look ahead, we remain ever-optimistic about the positive price forecasts, while PPGPL continues to monitor market uncertainties and implement value-added strategies. PPGPL is unwavering in its commitment to strategic growth, prioritising the following: safe operations; high plant reliability and availability; meeting customer needs and sustaining market presence across all territories. These efforts are critical to delivering long-term shareholder value.