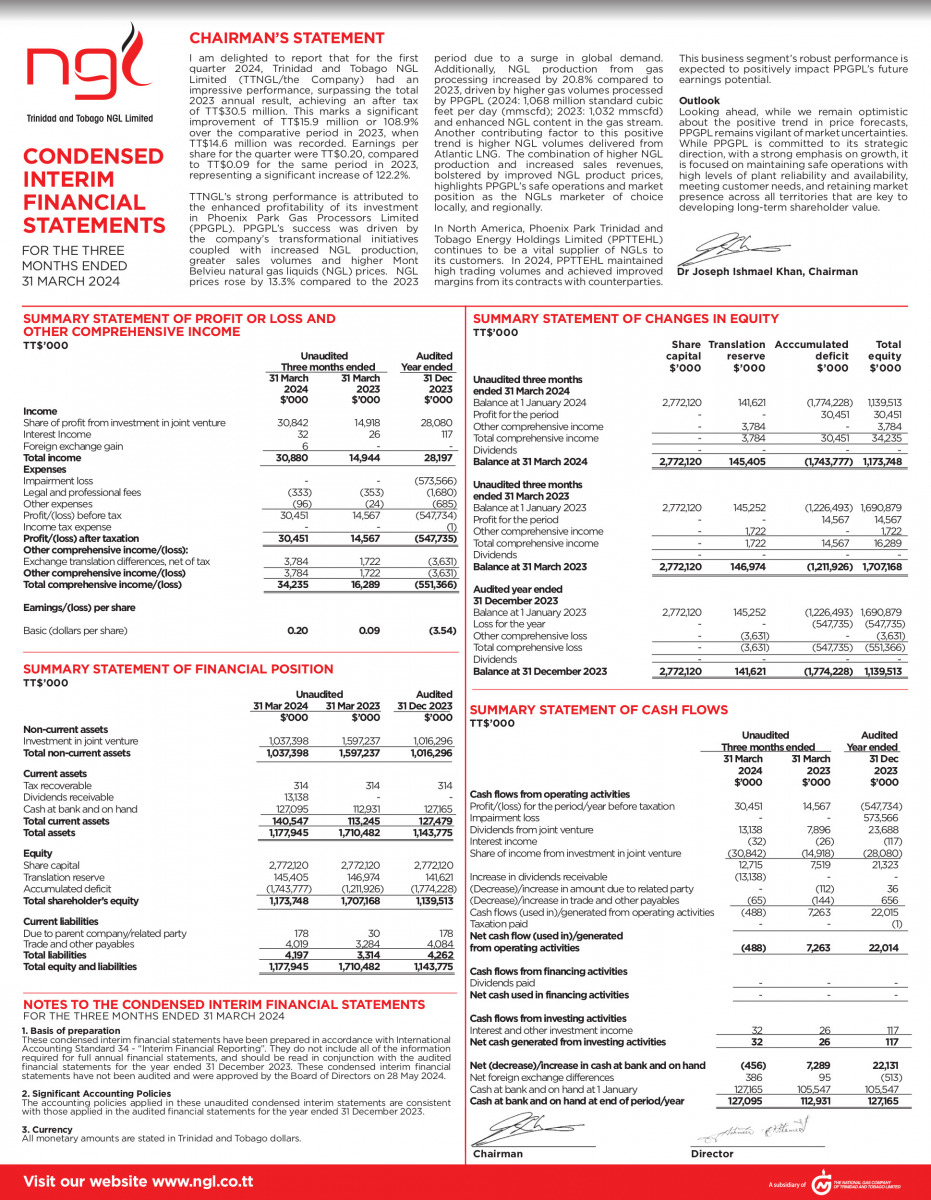

Chairman’s Statement:

I am delighted to report that for the first quarter 2024, Trinidad and Tobago NGL Limited (TTNGL/the Company) had an impressive performance, surpassing the total 2023 annual result, achieving an after tax of TT$30.5 million. This marks a significant improvement of TT$15.9 million or 108.9% over the comparative period in 2023, when TT$14.6 million was recorded. Earnings per share for the quarter were TT$0.20, compared to TT$0.09 for the same period in 2023, representing a significant increase of 122.2%.

TTNGL’s strong performance is attributed to the enhanced profitability of its investment in Phoenix Park Gas Processors Limited (PPGPL). PPGPL’s success was driven by the company’s transformational initiatives coupled with increased NGL production, greater sales volumes and higher Mont Belvieu natural gas liquids (NGL) prices. NGL prices rose by 13.3% compared to the 2023 period due to a surge in global demand. Additionally, NGL production from gas processing increased by 20.8% compared to 2023, driven by higher gas volumes processed by PPGPL (2024: 1,068 million standard cubic feet per day (mmscfd); 2023: 1,032 mmscfd) and enhanced NGL content in the gas stream. Another contributing factor to this positive trend is higher NGL volumes delivered from Atlantic LNG. The combination of higher NGL production and increased sales revenues, bolstered by improved NGL product prices, highlights PPGPL’s safe operations and market position as the NGLs marketer of choice locally, and regionally.

In North America, Phoenix Park Trinidad and Tobago Energy Holdings Limited (PPTTEHL) continues to be a vital supplier of NGLs to its customers. In 2024, PPTTEHL maintained high trading volumes and achieved improved margins from its contracts with counterparties. This business segment’s robust performance is

expected to positively impact PPGPL’s future earnings potential.

Outlook

Looking ahead, while we remain optimistic about the positive trend in price forecasts, PPGPL remains vigilant of market uncertainties. While PPGPL is committed to its strategic direction, with a strong emphasis on growth, it is focused on maintaining safe operations with high levels of plant reliability and availability, meeting customer needs, and retaining market presence across all territories that are key to developing long-term shareholder value.