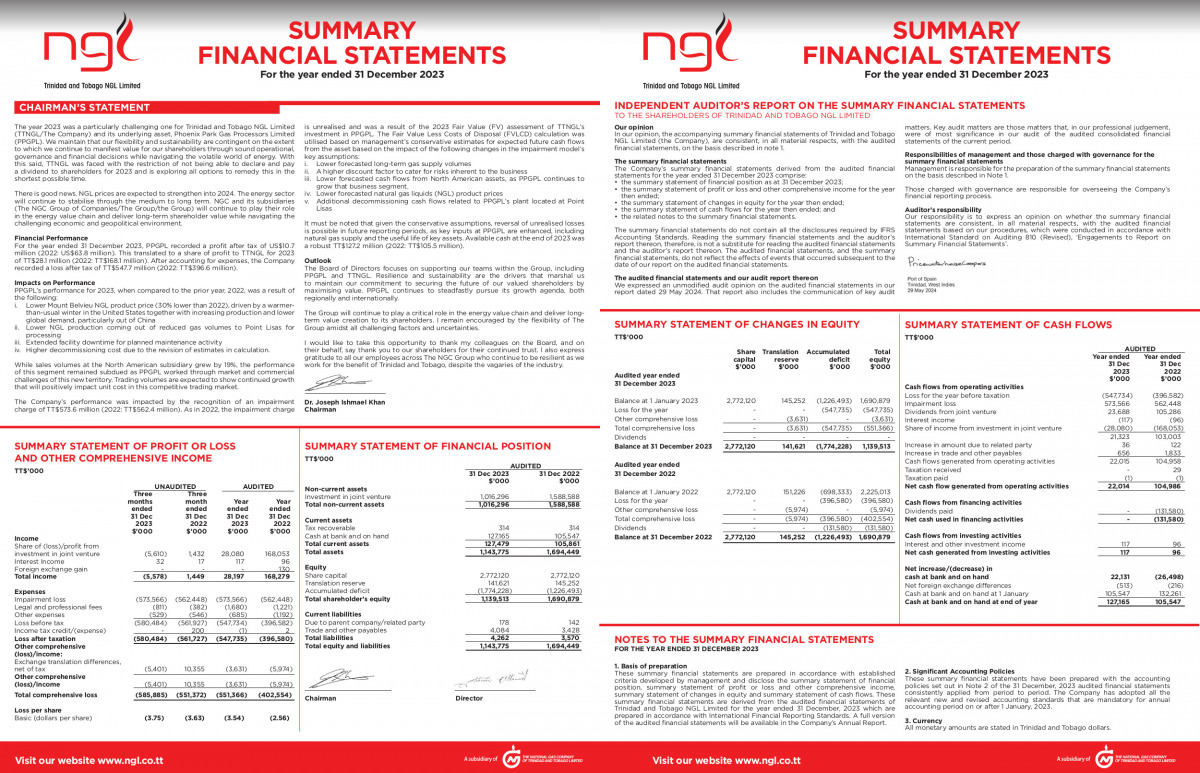

The year 2023 was a particularly challenging one for Trinidad and Tobago NGL Limited (TTNGL/The Company) and its underlying asset, Phoenix Park Gas Processors Limited (PPGPL). We maintain that our flexibility and sustainability are contingent on the extent to which we continue to manifest value for our shareholders through sound operational, governance and financial decisions while navigating the volatile world of energy. With this said, TTNGL was faced with the restriction of not being able to declare and pay a dividend to shareholders for 2023 and is exploring all options to remedy this in the shortest possible time.

There is good news. NGL prices are expected to strengthen into 2024. The energy sector will continue to stabilise through the medium to long term. NGC and its subsidiaries (The NGC Group of Companies/The Group/the Group) will continue to play their role in the energy value chain and deliver long-term shareholder value while navigating the challenging economic and geopolitical environment.

Financial Performance

For the year ended 31 December 2023, PPGPL recorded a profit after tax of US$10.7 million (2022: US$63.8 million). This translated to a share of profit to TTNGL for 2023 of TT$28.1 million (2022: TT$168.1 million). After accounting for expenses, the Company recorded a loss after tax of TT$547.7 million (2022: TT$396.6 million).

Impacts on Performance

PPGPL’s performance for 2023, when compared to the prior year, 2022, was a result of the following:

- Lower Mount Belvieu NGL product price (30% lower than 2022), driven by a warmer-than-usual winter in the United States together with increasing production and lower global demand, particularly out of China.

- Lower NGL production coming out of reduced gas volumes to Point Lisas for processing.

- Extended facility downtime for planned maintenance activity.

- Higher decommissioning cost due to the revision of estimates in calculation.

While sales volumes at the North American subsidiary grew by 19%, the performance of this segment remained subdued as PPGPL worked through market and commercial challenges of this new territory. Trading volumes are expected to show continued growth that will positively impact unit cost in this competitive trading market.