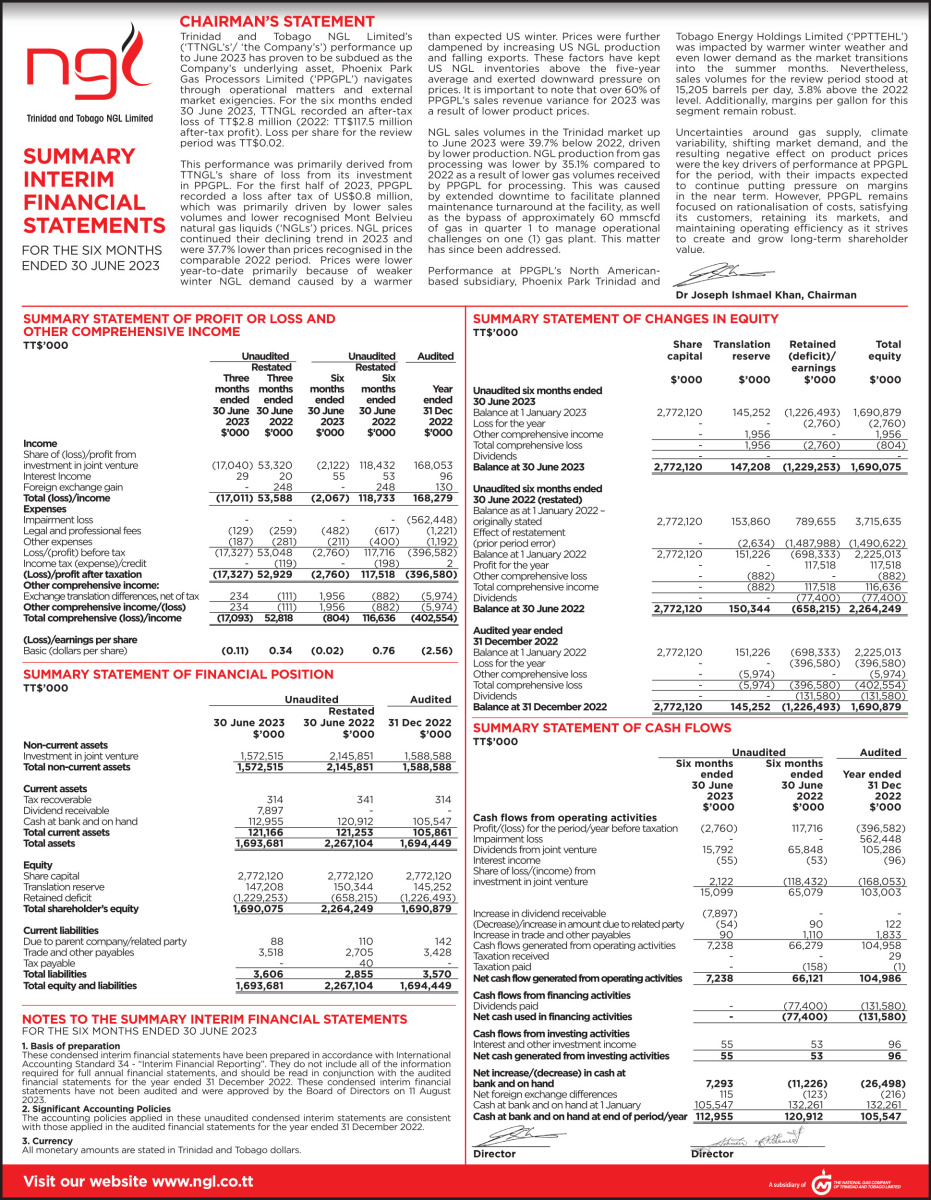

Trinidad and Tobago NGL Limited’s (TTNGL’s’/’the Company’s’) performance up to June 2023 has proven to be subdued as the Company’s underlying asset, Phoenix Park Gas Processors Limited (‘PPGPL’) navigates through operational matters and external market exigencies. For the six months ended 30 June 2023, TTNGL recorded an after-tax loss of TT$2.8 million (2022: TT$117.5 million after-tax profit). Loss per share for the review period was TT$0.02.

This performance was primarily derived from TTNGL’s share of loss from its investment in PPGPL. For the first half of 2023, PPGPL recorded a loss after tax of US$0.8 million, which was primarily driven by lower sales volumes and lower recognised Mont Belvieu natural gas liquids (‘NGLs’) prices. NGL prices continued their declining trend in 2023 and were 37.7% lower than prices recognised in the comparable 2022 period. Prices were lower year-to-date primarily because of weaker winter NGL demand caused by a warmer than expected US winter. Prices were further dampened by increasing US NGL production and falling exports. These factors have kept US NGL inventories above the five-year average and exerted downward pressure on prices. It is important to note that over 60% of PPGPL’s sales revenue variance for 2023 was a result of lower product prices.

NGL sales volumes in the Trinidad market up to June 2023 were 39.7% below 2022, driven by lower production. NGL production from gas processing was lower by 35.1% compared to 2022 as a result of lower gas volumes received by PPGPL for processing. This was caused by extended downtime to facilitate planned maintenance turnaround at the facility, as well as the bypass of approximately 60 mmscfd of gas in quarter 1 to manage operational challenges on one (1) gas plant. This matter has since been addressed.